Good Morning, Welcome to FWQRC Regulatory Focus News Letter

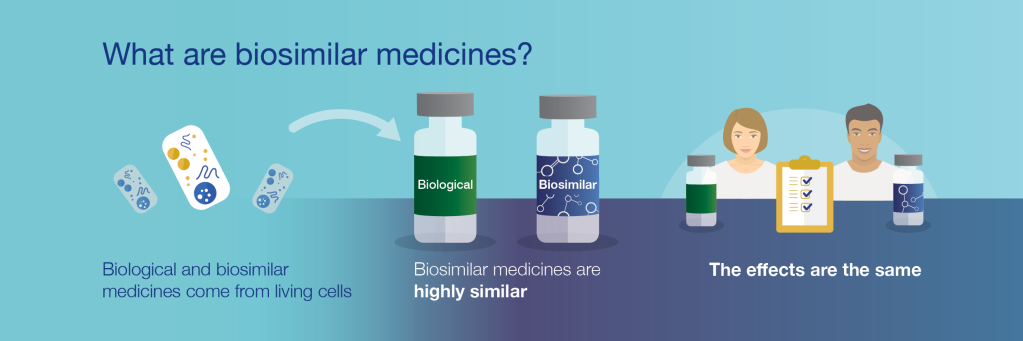

Today We are going to review the benefits and concerns on biosimilar drugs

Pathway for approvals was initiated in 2009.

Ten years later (or less than five years since the first FDA approval of a biosimilar), and just 42% (11 out of 26) of FDA-approved biosimilars have launched. But in the next three months , a clutch of new biosimilars will hit the market, including new ones in oncology, hinting at a wave of uptake.

For instance, Pfizer is expected to launch three biosimilars soon: one for Avastin (bevacizumab) later this month, one for Rituxan (rituximab) next month, and one in February for Herceptin (trastuzumab). Two other trastuzumab biosimilars may also launch soon, which would mean more than 60% of biosimilars approved in the US will have launched by early next year.

The rising number of launches, combined with an increasing amount of quick uptake, may put biosimilar foes on their heels.

For instance, Neulasta (pegfilgrastim) biosimilars have found recent success, with Coherus’ Udenyca (pegfilgrastim-cbqv) and Mylan and Biocon’s Fulphila (pegfilgrastim-jmdb) capturing 25% market share in just over a year, according to a report released last week from Bernstein.

Similarly, a sign of rapid uptake can be seen with Amgen’s Mvasi (bevacizumab-awwb), which has captured 10% of the Avastin market in just four months.

“Biosimilars are growing their market share and leading to meaningful price erosion over time; with the more recent biosimilar launches showing a lot of success – reflecting perhaps the growing market sophistication of the biosimilar companies,” former FDA Commissioner Scott Gottlieb, referring to the Bernstein report, noted recently.

And in the future, Humira (adalimumab) and Enbrel (etanercept) biosimilars (seven approved, zero launched int he US) may look more like outliers in a larger pool of approvals and subsequent launches. By contrast, in the EU, Humira biosimilars have already captured 35% of the multi-billion-dollar market in one year, and biosimilars have captured 50% of the Enbrel market in about three years, according to Bernstein.

The US Remicade (infliximab) biosimilar market is also an eyesore (Bernstein refers to it as “essentially a failed market”) as the two biosimilar entrants have only amassed 12% market share in more than two years. Amgen’s infliximab biosimilar was recently approved last week and may hit the market soon. And Johnson & Johnson said the Federal Trade Commission has launched an investigation into its contracting practices for Remicade, although similar investigations in Canada and the UK yielded little.

Thank you for visiting FWQRC blogs…..

Contact FWQRC™ for GMP Training, Auditing by QP, eCTD, GAP Analysis, Risk Assessment, CAPA, CSV, Method development/Validation, ADE/PDE Values, Facility & Product Registrations